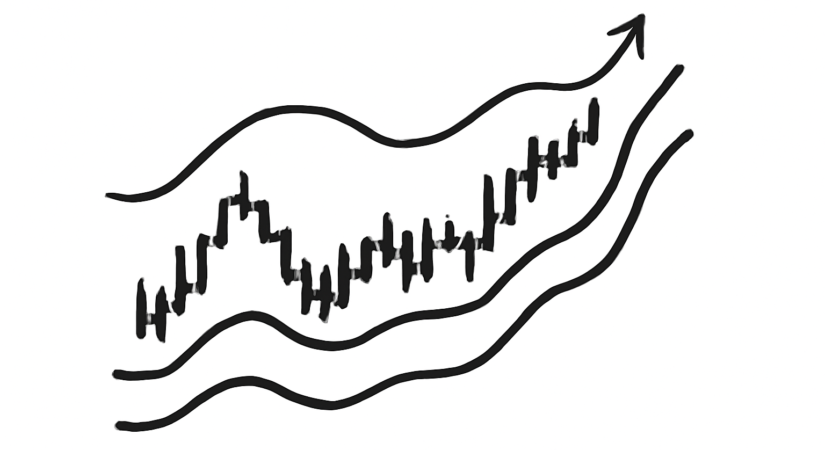

XRP is trading near $2.11 on Binance, and monthly Bollinger Bands suggest a clear price framework heading into 2026.

On the monthly TradingView chart, the upper Bollinger Band sits around $3.58. This level underpins the idea of a potential move of roughly 75% toward $3.5, which is treated as a rounded representation of the current upper band.

The key reference point is the middle Bollinger Band near $1.90. As long as XRP holds above this level on monthly closing prices, it signals that the market is accepting a higher trading range. In that scenario, pullbacks are viewed as part of a consolidation or “reload” phase rather than the end of an advance, and the upper band near $3.5 becomes a more realistic target.

If XRP falls below $1.90 and fails to reclaim it on a closing basis, the setup changes. A sustained break under the mid-band would suggest that the attempt to transition into a higher range has failed.

Under that bearish case, rallies are more likely to be sold, price action could revert to sideways trading, and the path toward the upper band around $3.5 would lose technical support. In this framework, the 2026 outlook is presented as a binary structure: $1.90 acts as a critical on–off level, with the potential move toward $3.5 contingent on XRP remaining above it.