JPMorgan Chase, the largest U.S. bank, announced on June 17 plans to issue a “deposit token” called JPMD. This digital token represents commercial bank money and will be available exclusively to the bank’s institutional clients.

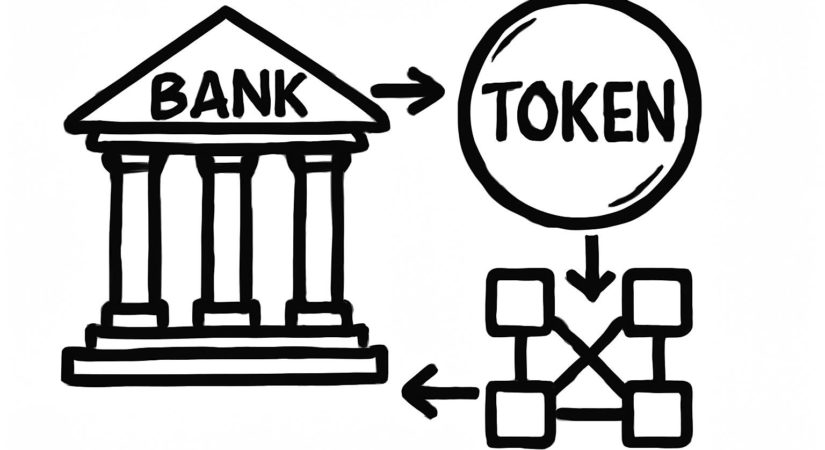

JPMD tokens are minted by JPMorgan and transferred through smart contract transactions on the Base network. Each JPMD token is fully backed by an equivalent fiat deposit, maintaining parity between on-chain tokens and off-chain liabilities. Unlike traditional stablecoins, these deposit tokens could eventually be insured and interest-bearing.

The launch marks the first deployment of deposit-based digital products by a major commercial bank on a public blockchain. It coincides with the U.S. Senate passing the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins of 2025 Act) by a 68-30 vote. The bill now advances to the House and aims to provide regulatory clarity for tokenized deposits, reducing legal uncertainty around stablecoins.

Though JPMorgan’s pilot is limited in scope and internal, it offers insight into how large financial institutions may address settlement efficiency, regulatory compliance, and market involvement using tokenized assets.

Other major banks like Bank of America, Citigroup, and Wells Fargo have reportedly discussed issuing joint stablecoins or tokens. JPMorgan’s early step positions it as a leader among big banks, though it emphasizes that JPMD is a deposit token rather than a stablecoin.

Technically, JPMD tokens correspond one-to-one with U.S. dollar deposits held at JPMorgan. Unlike many stablecoins issued by nonbank entities and backed by custodial reserves, JPMD tokens originate from within the regulated banking system, subject to standard oversight including liquidity requirements and counterparty risk assessments.

JPMorgan aims to maintain traditional banking standards within a digital framework. The pilot on Base, an Ethereum-compatible Layer 2 network with institutional oversight, balances interoperability with regulatory control.

Unlike stablecoins targeting retail and crypto users, deposit tokens are designed for institutional needs such as treasury system integration, potential interest earnings, and use in tokenized securities settlement.

Advocates like Rohit Chopra, former CFPB director, have supported tokenized bank deposits as the foundation for U.S. stablecoins. This comes as stablecoin reserve backing faces scrutiny, with proposed U.S. regulations requiring 1:1 backing by U.S. Treasuries, issuance by regulated entities, and enhanced audits and AML measures.