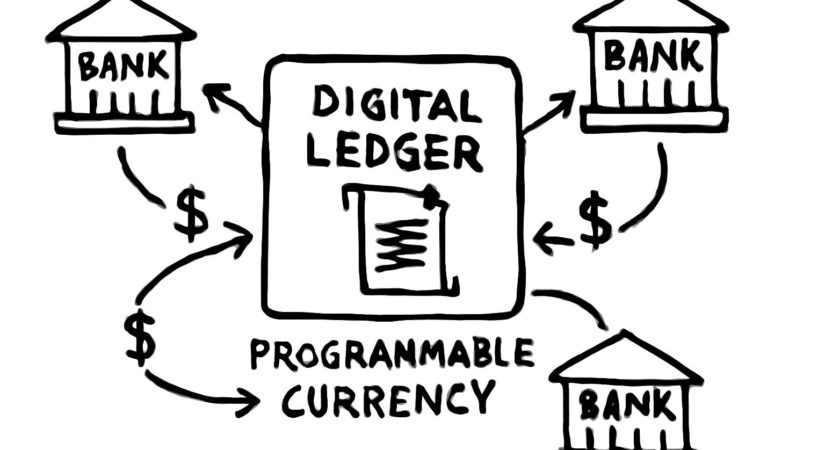

Project Agora, a collaboration between major central banks and commercial banks, aims to develop a programmable multicurrency ledger that integrates tokenized commercial bank deposits with wholesale central bank money. This initiative could reshape how digital money operates, particularly in cross-border and institutional payments.

Announced in April 2024, Project Agora involves the Bank for International Settlements (BIS) alongside central banks including the Federal Reserve Bank of New York, Bank of England, Bank of France, Bank of Japan, Bank of Korea, Bank of Mexico, and the Swiss National Bank. They collaborate with private sector banks such as Citi, HSBC, Deutsche Bank, Standard Chartered, Lloyds Bank, and infrastructure providers like SWIFT, Euroclear, SDX, Visa, and Mastercard. The Institute of International Finance coordinates these efforts.

The project tests blockchain technology under real operational, regulatory, and legal conditions, leveraging smart contracts to automate payments, compliance, and settlement processes. BIS Innovation Hub Head Cecilia Skingsley emphasized that the initiative seeks to combine innovation with regulatory safeguards. BIS Economic Adviser Hyun Song Shin noted the importance of maintaining monetary system integrity and governance.

Project Agora challenges the current stablecoin model by offering a regulated, programmable fiat alternative. This could diminish the role of private stablecoins—such as USDC and USDT—that have gained popularity due to their near-instant settlements and global reach. However, concerns over reserve transparency, regulatory gaps, and concentration of private power persist with these tokens.

Former Consumer Financial Protection Bureau Director Rohit Chopra has advocated for tokenized bank deposits backing U.S. stablecoins, aligning with Agora’s approach.

While private stablecoins have pushed traditional financial systems to innovate, Project Agora seeks to crowd out unregulated tokens in institutional and interbank transfers by maintaining public trust and oversight. This approach raises the compliance and resilience standards stablecoin issuers must meet to remain competitive.

Though still experimental, Project Agora aims to produce functional code and tangible payment flows, potentially marking a turning point in digital currency integration with mainstream finance.