Stablecoins, once seen as niche crypto tools, are gaining traction as potential infrastructure for commerce by disrupting traditional issuer-merchant-acquirer roles. Major companies like Walmart and Amazon reportedly explore issuing their own stablecoins. Shopify has started enabling merchants to accept USDC stablecoins within current payment and fulfillment systems. Visa partnered with Bridge to launch a stablecoin credit card, while Stripe acquired digital wallet firm Privy to simplify crypto onboarding for merchants and consumers.

Despite this momentum, questions remain about stablecoins’ role: Are they merely faster, programmable payment settlements, or emerging as digital-native issuers replacing banks? Additionally, how will established card ecosystem features like chargebacks, fraud management, and liability coverage adapt if stablecoins change value movement methods?

Stablecoins as a Settlement Layer

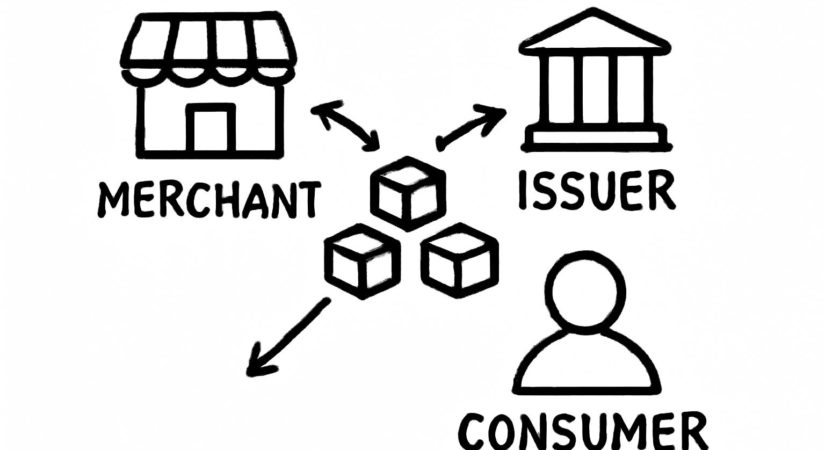

Traditional payment transactions involve multiple intermediaries, adding cost and delay. Stablecoins offer a more efficient settlement layer, enabling faster, traceable, and lower-cost money transfers with reduced counterparty risk. However, the challenge arises in assigning responsibility if issues occur during transfers.

Using stablecoins directly for consumer payments—from wallets like Circle’s to Web3 debit cards—positions stablecoin providers as neo-issuers enabling stored-value payments outside traditional card infrastructure. Unlike established card networks with standardized dispute resolution and shared liability, stablecoin systems often lack clearly defined rules. Emerging decentralized identity and escrow solutions remain in early development.

Chargebacks, Liability, and Compliance Challenges

Traditional payment systems allow reversibility through chargebacks initiated by issuers and adjudicated by networks, backed by consumer protection laws such as Regulation Z and Regulation E. Stablecoin transactions, once confirmed on-chain, are generally final and irreversible. While this feature supports automation and fraud prevention, it complicates error handling and dispute resolution.

Globally, stablecoins are serving diverse roles beyond Western markets. In inflation-hit Argentina, stablecoins like USDC and USDT provide dollar-based stability absent from local banking. In Nigeria, they bypass capital controls and limited cross-border payment options. There, stablecoins act as the payment method itself, with wallets functioning as issuers and protocols substituting networks. Local fintech firms combine roles as acquirers, remittance agents, and custodians, calling into question the relevance of the traditional stack.

Overall, stablecoins are unlikely to fully replace the issuer-acquirer model soon. A hybrid system where stablecoin payments coexist with fiat rails appears probable, especially in cross-border commerce, digital marketplaces, and creator economies.