Stablecoins, once considered niche crypto assets, are gaining traction as potential infrastructure for commerce by challenging traditional issuer-merchant-acquirer roles.

Retail giants like Walmart and Amazon are exploring their own stablecoins, while Shopify recently enabled merchants to accept USDC stablecoins within their payment systems. In April, Visa partnered with Bridge to launch a stablecoin credit card. Meanwhile, Stripe acquired digital wallet firm Privy to simplify crypto onboarding for merchants and consumers.

Despite growing interest, uncertainty remains about stablecoins’ regulatory oversight, standards, and risk management. Key questions include whether stablecoins are merely faster, programmable payment settlement tools or emerging as new digital issuers replacing traditional bank networks. Their impact on established card ecosystem features such as chargebacks, fraud management, and liability coverage is also unresolved.

Stablecoins as a Faster Settlement Layer

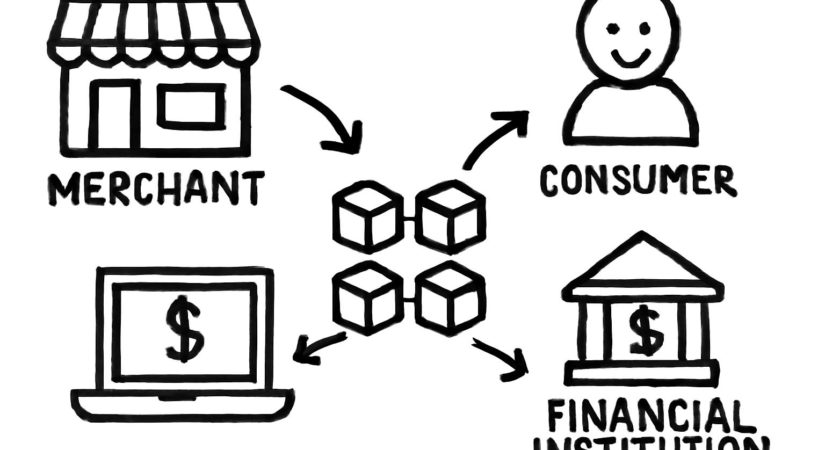

The conventional issuer-acquirer-merchant framework involves multiple intermediaries, slowing transaction speed and increasing costs. Stablecoins offer a faster, more cost-efficient settlement method with benefits like traceability and reduced counterparty risk.

However, responsibilities and accountability in case of failures remain unclear. When stablecoins serve as the payment medium, such as through wallets or Web3 debit cards, providers resemble neo-issuers facilitating stored-value payments outside traditional card networks. Unlike established card systems with standardized dispute resolution and shared liability, many stablecoin protocols lack mature rules and rely on early-stage solutions like decentralized identity and escrow.

This evolving dynamic could collapse the traditional payments stack by bypassing banks and card networks for issuance and settlement.

Challenges with Chargebacks, Liability, and Compliance

Traditional payments offer consumer protections including chargeback processes governed by legal frameworks like Regulation Z (credit cards) and Regulation E (debit cards). Stablecoin transactions, confirmed on-chain, are generally irreversible, which complicates error correction and dispute resolution. While this enhances automation and fraud resistance, it introduces risks where consumer protections are weak or absent.

In markets such as Latin America, Sub-Saharan Africa, and Southeast Asia, stablecoins address unique challenges. For instance, in Argentina, where inflation exceeds 100%, stablecoins provide dollar-pegged stability unavailable from local banks. In Nigeria, stablecoins circumvent capital controls and restricted international payments. Here, stablecoins function as primary payment methods, with wallets acting as issuers and protocols taking the place of networks, supported by local fintechs playing multifaceted roles.

This scenario questions the relevance of the traditional payments stack in certain regions.

Overall, stablecoins are unlikely to fully replace the issuer-acquirer model soon. A hybrid ecosystem is more plausible, where stablecoin payments coexist with fiat rails, especially across cross-border transactions, digital marketplaces, and creator economies.